Our Suite of Solutions

Explore our powerful solutions designed to automate and optimize your financial operations.

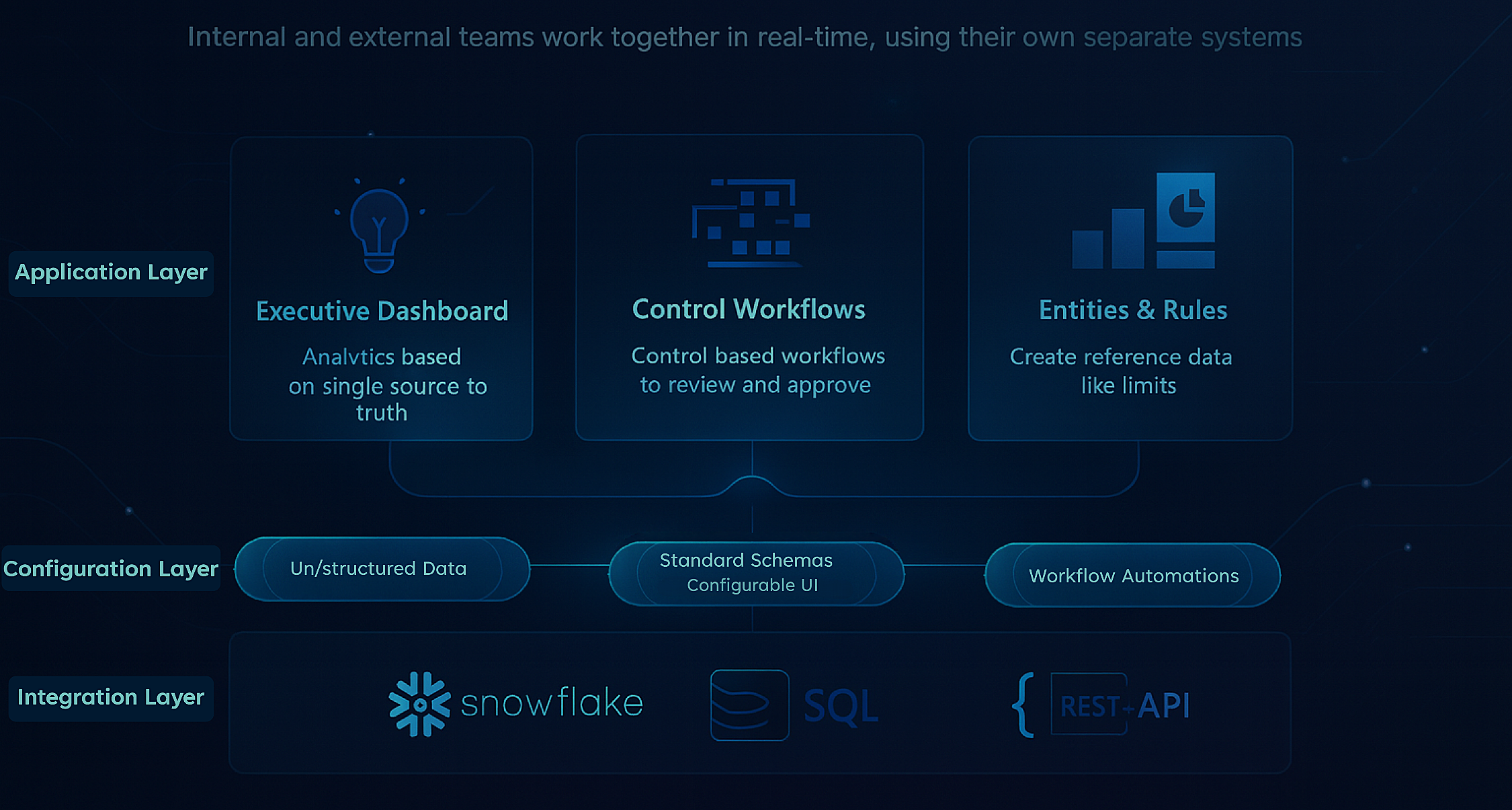

Data Hub provides a modern, centralized user interface built natively for asset managers. It seamlessly connects to any API or database, including Snowflake and SQL, to unify your data streams, enabling streamlined workflows and powerful analytics. This creates a single point of access for all your enterprise data, enabling streamlined workflows, enhanced data visualization, and more powerful analytics. Empower your teams with a consistent and intuitive experience for interacting with complex financial data.

Key Features

- Significant Value

- Operational Efficiency

- Ensuring Data Accuracy and Compliance

- Advanced Analytics and Insights

Benefits

Implementing our Data Hub - Modern Central UI for Enterprise solution provides tangible benefits to your organization, including a single source of truth, streamlined workflows, and empowered decision-making through intuitive data visualization and powerful analytics.

Pre-Trade

We help you identify and vet new opportunities with powerful due diligence and valuation tools. Our system automates the screening process, allowing your team to focus on high-potential deals, accelerate proposals, and secure funding faster.

Our tools support portfolio optimization using algorithmic models and provide detailed performance tracking, empowering you to make data-driven choices and approve investments with confidence.

Drive smarter investment decisions with our robust research and analytics. We have AI driven models that can distil news and provide alternative allocation suggestions for the portfolios.

Trading

Our platform provides a single source for managing trade orders, ensuring rapid and compliant execution. From capturing orders to pre-trade compliance checks, we streamline the entire process, minimizing errors and maximizing efficiency.

Gain a competitive edge with our dynamic portfolio management solutions. We offer real-time monitoring, strategic asset allocation, and rebalancing tools to optimize performance and track live P&L, helping you stay ahead of market shifts.

Build and maintain strong client relationships with our integrated platform. From managing investor pipelines to executing targeted campaigns and handling correspondence, we ensure a seamless and professional client experience from onboarding onward.

Post-Trade

Our system simplifies the complex process of trade settlement. It automates confirmations, manages investment terms, and handles fee allocations, ensuring accuracy and reducing the time and resources needed to finalize transactions.

Our platform centralizes market data integration, providing a single, reliable source for everything from pricing liquidity to rates and curves. This ensures that all valuation models and decisions are based on the most accurate, up-to-the-minute information.

Automate the administrative burdens of asset management. Our tools handle corporate actions, process income, and service OTC derivatives, freeing up your team to focus on higher-value tasks.

We eliminate operational risk by providing a comprehensive reconciliation engine. Our tools perform automated checks on positions, cash, and transactions, integrating with TPA and custodial systems to ensure all data is consistent and accurate.

Optimize your firm's liquidity and financial health with our cash management tools. We provide a clear view of daily cash flows, offer precise ladder forecasts, and help you manage margin and collateral effectively.

Our treasury function supports strategic financial management. From allocating money market funds and hedging FX balances to planning for financing and short positions, we provide the tools to manage your firm's capital effectively.

Transparency

Maintain full control over your portfolio's integrity. We provide official NAV and P&L calculations, manage AUM, and streamline reconciliation processes, ensuring all financial data is verifiable and accurate for audits and reporting.

Proactively protect your firm from market, trading, and counterparty risks. Our system calculates key metrics like VaR and provides a firm-wide view of risk exposure, enabling timely and informed risk mitigation strategies.

Stay compliant in a complex regulatory landscape. We monitor against restricted lists, calculate compliance requirements, and track fund limits, ensuring all operations adhere to regulatory and SEC standards with minimal manual effort.

Go beyond simple returns to understand what drives your performance. Our analytics provide detailed performance attribution, including Brinson model calculations, to help you identify the true sources of alpha and underperformance.

Ensure the integrity and security of your core data. Our system provides a centralized repository for security masters and counterparty data, establishing a single source of truth for all legal and account information.

Deliver clear, comprehensive reports to your investors effortlessly. Our platform automates the creation of reports detailing investment breakdowns, NAV, and performance, ensuring your investors are always well-informed.

Accounting

This function is the backbone of your firm's financial operations. We capture every transaction, maintain trial balances, and perform daily pricing, ensuring accurate and transparent accounting for tax lots and all holdings.

We simplify corporate financial management and tax compliance. Our system automates expense allocation, manages payables and receivables, and assists with tax forms, ensuring your corporate books are always organized and ready.

Streamline the complex process of investor and partner compensation. We automate investor allocation, management fee calculations, and incentive fee calculations, providing transparency and accuracy in all partner-related financial activities.

Ready to Transform Your Operations?

Let's discuss how DataAlpha can tailor a solution to fit your unique needs.

Book a Demo